reconciliation use case

Comprehensive solutions for

payments reconciliation

Message format headaches gone

Banks and firms are adapting to to multitude of payment methods, including traditional bank transfers, credit cards, digital wallets, and emerging cryptocurrencies, each with their own data formats and processing timelines.

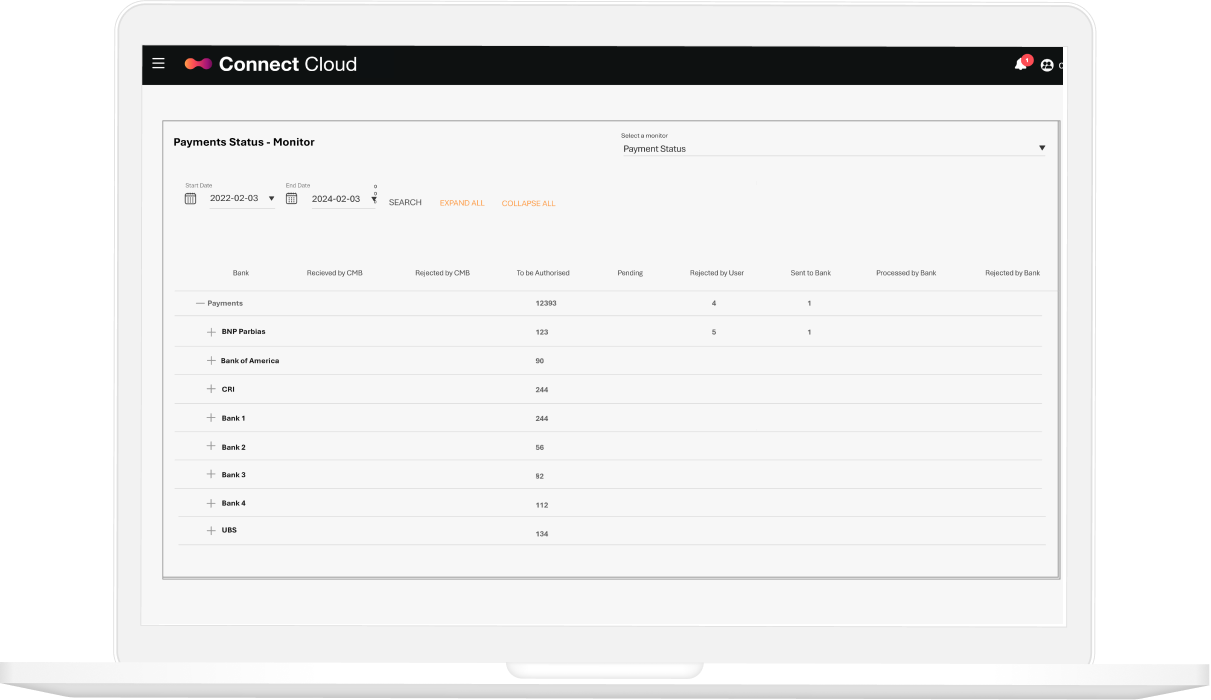

Gresham's Control Cloud solution seamlessly integrates with existing systems, automating data collection, normalization, and matching across multiple platforms and message formats.

Simplify the process

Financial institutions implementing Gresham's Control Cloud reconciliation solutions experience a dramatic transformation in their operational efficiency and risk management.

The automated reconciliation cycle significantly reduces manual effort, minimizes errors, and accelerates the entire process, allowing firms to handle increasing transaction volumes with ease.

Reconciliation, made simple

our solutions

Explore our other

reconciliation use cases

-

ABOR to IBOR

reconciliation -

Cash and stock

reconciliation -

Bank and account reconciliation

-

Payments

reconciliation -

Investment management reconciliation

-

Fee billing

reconciliation -

N-Way

reconciliation -

Build inhouse reconciliation

Gresham’s Control is easy for our business users to adopt and use. The application’s controls around signoffs, designating reconciliations to different staff, and data collection have made our process more efficient and seamless, and our team more self-sufficient.

Vice President of Operations | Investment Management Firm

Our recent success and go-live with Gresham’s Control Cloud and the prompt yet comprehensive Proof-of-Concept (PoC) meant the decision to expand our use to include Connect Cloud was easy.

Head of Operations Payments | Cash and Securities Provider

Why should any payments firm build this in-house when there is a specialist like Gresham that focuses on it exclusively? Connect Cloud really takes the pain out of message formatting and simplifies the message transformation space.

Product Manager | Global FinTech Company

The solution allows us to focus on more strategic work. We are now able to manage the exceptions rather than all the manual heavy lifting we were having to do before the switch. It meant that we were able to manage a broader estate of recs ourselves without involving IT and tech experts from the previous vendor.

Operations Lead | Global Asset Manager

Project Lead | Global Investment Bank

Explore our customer success stories

Insights, made simple

Deep dive into an array of topics and opinions shared by our domain experts. Learn more from articles online or subscribe to our monthly newsletter on LinkedIn.

-1.png)