reconciliation CAPABILITIES

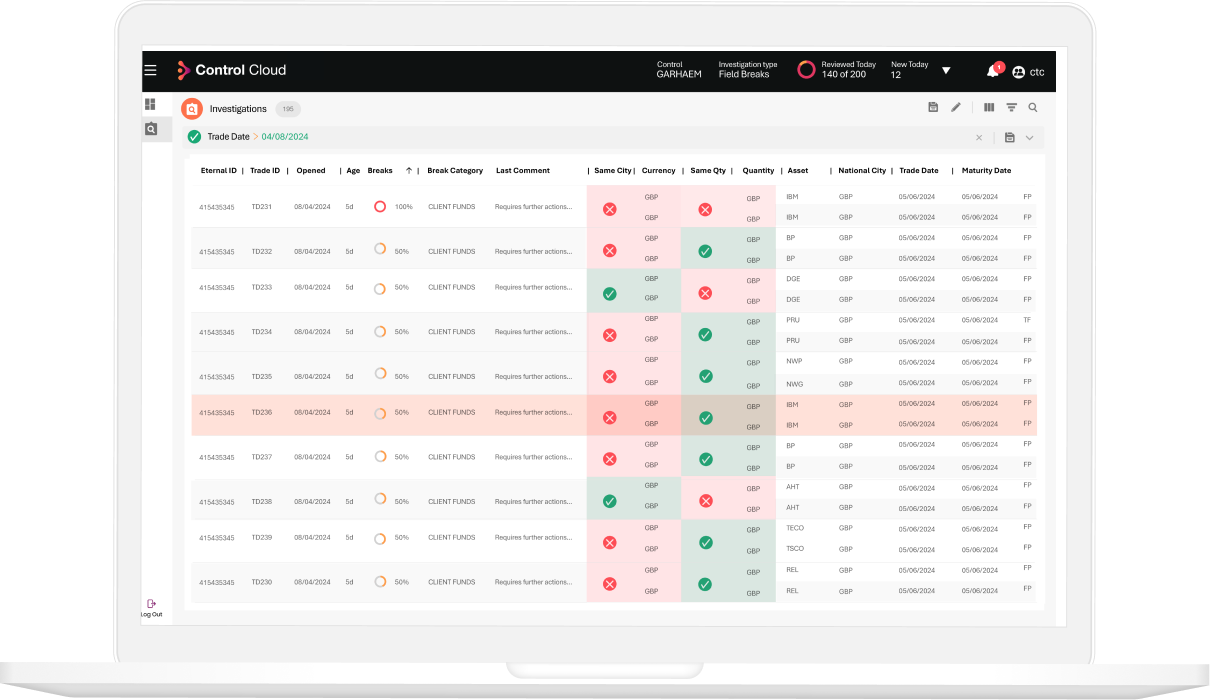

Workflow complexities, made simple

Advanced machine learning

Gresham’s comprehensive array of reconciliation solutions deliver market leading match rates, leverage intelligent automation to streamline workflows and provide end-to-end visibility across your financial reporting environment.

Data you can trust

Trusted by the world's leading financial institutions to process trillions of transactions per day, Gresham solutions are leading the way in data automation. Designed from the ground up to load, validate and match data of any complexity.

Technology built by experts

With over three decades of experience we have built industry leading products, customisable to your specific business requirements. No matter what part of your reconciliation process you are looking to improve, we have the solution for you.

key benefits

Take control of your reconciliation workflows

-

Real-time reconciliations

Boost reconciliation efficiency and accuracy while increasing transparency across post-trade workflows.

-

Buy-side specialisation

Asset managers, hedge funds and administrators rely on Gresham to mitigate risk, maximise efficiency, and revenue

-

Sell-side simplicity & scale

Tier one universal banks and broker-dealers use Gresham to control the risks inherent to their complex, high-volume transactions.

-

Operational efficiency

Break free from outdated systems and processes, eliminate workflow gaps and complicated manual spreadsheets

-

Cutting-edge engineering

Machine learning delivers smarter insights for intelligent matching and managed services, freeing up time for value-added tasks.

-

Delivery & service flexibility

Whether its cloud-hosted, on-premises, or hybrid - optimise your workflows for peak efficiency and control 24/7.

Reconciliations, made simple

Related products and services

Our industry-tailored technology and experienced team are ready to address your unique financial service needs.

Discover our comprehensive reconciliation solutions and expert support options today.

Reconciliation solutions

Reconciliation use cases

-

ABOR to IBOR

Compare multiple data sets in one view, allowing for seamless, large-scale data comparisons. -

Payments

Enable complete, enterprise-wide visibility on the status of payments and cash positions. -

Cash + stock

Verify your stock records to ensure accuracy and consistency in transactions and holdings. -

Bank account reconciliation

Identify discrepancies in all transactions so they reflect your accounting records. -

Build vs. buy

This crucial decision helps financial organisations balance the costs, capabilities, and long-term needs of their business.

-

Crypto + digital assets

Unlock the future of finance with seamless solutions for managing and trading digital assets.

-

Custody + clearing

Enhance security and efficiency with cutting-edge custody and clearing solutions for modern markets.

-

Derivatives

Navigate the complexities of derivatives with streamlined tools that maximize control and minimize risk.

-

Nostro + depot

Optimize liquidity and ensure precision with advanced solutions for Nostro and Depot account management.

Gresham’s Control is easy for our business users to adopt and use. The application’s controls around signoffs, designating reconciliations to different staff, and data collection have made our process more efficient and seamless, and our team more self-sufficient.

Vice President of Operations | Investment Management Firm

Our recent success and go-live with Gresham’s Control Cloud and the prompt yet comprehensive Proof-of-Concept (PoC) meant the decision to expand our use to include Connect Cloud was easy.

Head of Operations Payments | Cash and Securities Provider

Why should any payments firm build this in-house when there is a specialist like Gresham that focuses on it exclusively? Connect Cloud really takes the pain out of message formatting and simplifies the message transformation space.

Product Manager | Global FinTech Company

The solution allows us to focus on more strategic work. We are now able to manage the exceptions rather than all the manual heavy lifting we were having to do before the switch. It meant that we were able to manage a broader estate of recs ourselves without involving IT and tech experts from the previous vendor.

Operations Lead | Global Asset Manager

Project Lead | Global Investment Bank

Explore our customer success stories

Insights, made simple

Deep dive into an array of topics and opinions shared by our domain experts. Learn more from articles online or subscribe to our monthly newsletter on LinkedIn.

-1.png)